Hitting your 40s doesn’t mean it’s too late to build serious wealth — in fact, it can be the best time to accelerate your financial growth. With higher income potential, clearer goals, and fewer risky decisions, investing after 40 can deliver impressive results — if done right.

Here’s where to put your money in 2025 for fast, smart growth without unnecessary risk.

📈 1. Growth-Oriented Index Funds & ETFs

✅ Why It Works:

- Instant diversification

- Low fees and strong long-term returns

- Great balance between growth and safety

🔥 Top Picks:

- VOO – S&P 500 ETF

- VGT – Vanguard Info Tech ETF

- QQQ – Nasdaq 100 ETF

💡 Consider a 60/40 split between growth and dividend funds for fast compounding and cash flow.

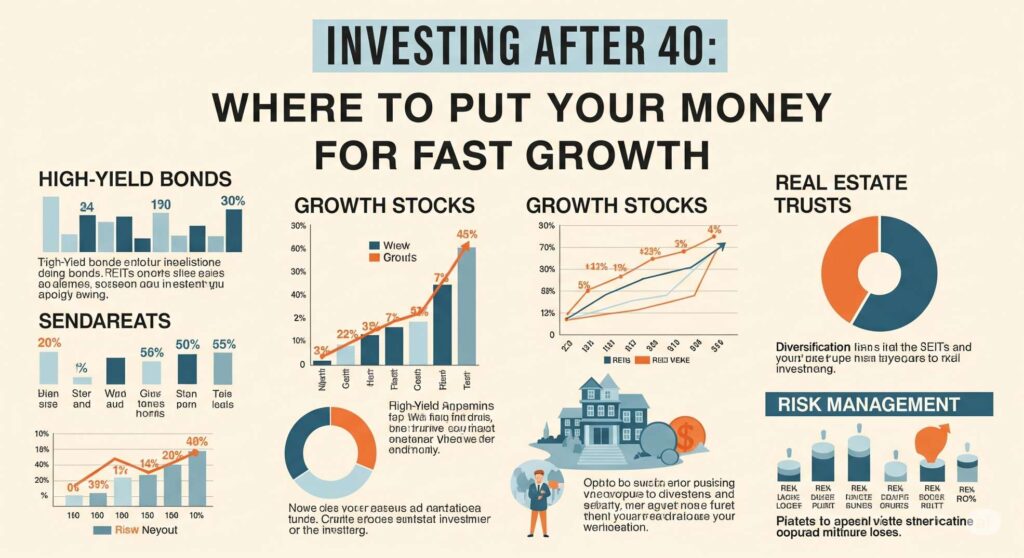

🏠 2. Real Estate (REITs & Rental Property)

✅ Benefits:

- Passive income and property appreciation

- Tax advantages and inflation protection

📌 2 Ways to Invest:

- REITs: No property management, 7%–10% returns

- Turnkey Rentals: Cash flow + equity growth

💡 Use platforms like Fundrise or Roofstock for hassle-free real estate investing.

💻 3. Roth IRA or Traditional IRA

✅ Why It’s Powerful at 40+:

- Tax-advantaged growth

- Catch-up contributions available

🔥 Strategy:

- Max out contributions: Up to $7,500/year

- Focus on growth ETFs or dividend stocks within your IRA

🪙 4. Crypto (Small Allocation)

✅ Why Consider It:

- High-growth potential, especially with long-term trends in Bitcoin and Ethereum

- Hedge against currency and inflation risk

⚠️ Limit to 5%–10% of your portfolio. Stick to top assets like BTC, ETH, or regulated crypto funds.

💼 5. Dividend Growth Stocks

✅ Why It’s Ideal at 40+:

- Reliable income + appreciation

- Great for reinvesting and compounding

Top Stocks in 2025:

- Apple (AAPL)

- Coca-Cola (KO)

- Procter & Gamble (PG)

💡 Reinvest dividends to maximize growth.

💵 6. High-Yield Savings + I Bonds

✅ For Stability & Liquidity:

- Earn 4%–5% APY on savings

- I Bonds adjust with inflation — great for safe, short-term growth

Use for emergency funds or short-term goals (1–3 years).

🧠 Bonus: Invest in Yourself

Upskilling in your 40s can lead to:

- Higher income

- Faster career growth

- More side hustle potential

Take certifications in AI, finance, project management, or digital business to boost your earning power.

✅ Final Thoughts

Investing after 40 is all about balance: strong growth with smart risk management. With focused strategies in ETFs, real estate, dividend stocks, and crypto, you can build wealth faster than ever before — even if you started late.

Leave a Reply